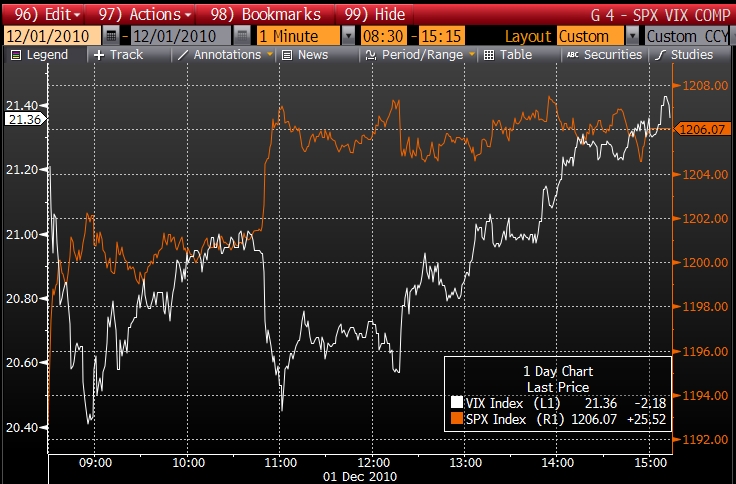

Stocks jumped on good economic news but the VIX shows contempt. The ADP Employment Change came in at 93k vs an estimate of 70k, ISM came in slightly better than expected, vehicle sales better than expected, and the Fed beige book is consistent with modest acceleration in activity for 4th quarter versus third quarter. As a response, stocks jumped over 2% nearly across the board and interest rates rose over 10bps. One issue that was interesting was a steady rise in the VIX as the day marched onward:

It almost seems that when bonds, the dollar, and equities start to move in directions that make sense – then the VIX needs to step out of line and start protesting. I do have to admit that we are in a precarious situation. Even though economic data is making more sense and interest rates are no longer plunging, it does not seem that there is much fuel for stocks to skyrocket. Today was a euphoric day, but we are not breaking into new territory but only teasing the 1200 level on the S&P 500. Maybe the fear is warranted and maybe the sovereign debt crisis is only in its infancy.

One interesting divergence that I have noticed has been the VIX versus the credit default levels (market embedded default probabilities) of the Eurozone PIIGS. As you can see, the VIX followed the Eurozone fear in the summer, but during the fall we have seen a very muted response from the VIX. Maybe we should be more scared that Europe is only a spotlight into the future of Great Britain, Japan and the United States and that the BRIC countries are not strong enough to pull us out of the ditch.