It seems that every pull back since the middle of March has only been an opportunity to buy rather than the beginning of a pullback. It does seem that the equity markets are starting to run out of steam, but shorting a rising market can be a terrible strategy so it makes sense to limit your losses on short positions. That is where options come into play. As an option trader, skew can be your friend or your enemy. Many individuals naively purchase out of the money puts as protection on their equity portfolios or short bets because they are “cheaper” in the sense that purchasing a put for $1 seems like a much better proposition than buying a put for $5. Unfortunately, for those who do not know better, the opposite is usually true.

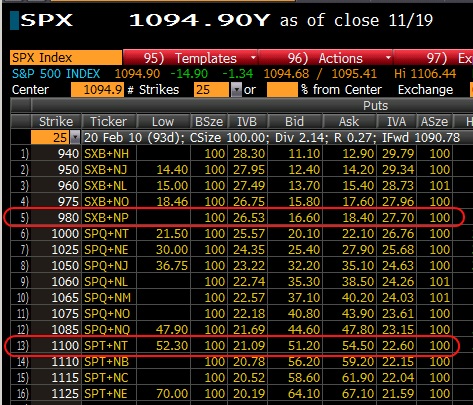

The skew measures the implied volatility of the option contracts across different strike prices for a given expiration. When the skew is very “steep” as it currently is, shown in the S&P 500 skew chart above, it tells you that the options on the left (below the current S&P price) are much more expensive from a volatility standpoint than the options on the right (above the S&P 500 price). In general, you can give yourself an edge trading options by buying options that have a lower implied volatility and selling options with a higher implied volatility.

This means that if you are looking at protecting your equity position in your portfolio by buying put options, you would be much better off buying a put that is at the money and selling one ormore puts that are 10%-15% out of the money.

By buying a put spread at 1100-980 you purchase the option with implied volatility of 21% and sell an option with implied volatility of 27%. This makes the hedge cheaper and gives you an edge from the start of the trade.