This Friday’s trading concluded the week with our often schizo “risk-on” mindset. It felt like a relief to have treasury yields rise instead of grind downward to an absolutely dis-inflationary 1%. Second quarter GDP came in higher than the consensus estimate and Ben Bernanke told the world that he would do anything in his power to fight deflationary threats, but at this moment it seems unnecessary to get the monetary weapons out of the arsenal. As far as my themes are concerned, I am certain that regular readers are tired of my pushing of dividend yielding stocks. In a world where only an idiot would buy stocks, I must be out of my mind. I hear a lot of talk about individuals and institutions being incapable of absorbing the inherent volatility of stocks, but they must not have read up on the volatility management strategies that are out there. Volatility? It seems rather incongruous that those very institutions shying away from equities would swallow up a 100 year 5.95% bond from Norfolk Southern. No duration/price volatility to see here…

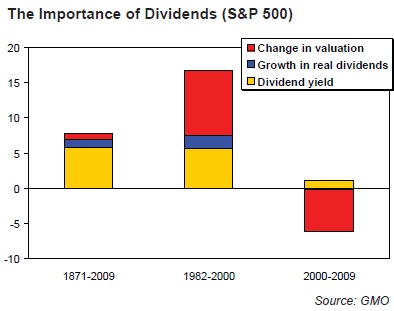

Dividends have fallen out of favor. That is a fact as investors were more concerned with price appreciation akin to the 1990-2000 run-up. Price movements are exciting! My $50 just went to $100! The truth is less glamorous. As James Montier from GMO points out, the return generator of the S&P 500 over a 1 year time horizon from price movement is nearly 80%, but over a 5 year time horizon dividend yields and dividend growth account for 80% of the return.

The truth is that companies that pay dividends actually believe in their earnings. If a company does not pay dividends, then they are usually uncertain about the volatility of their earnings or they believe that it is best to invest their cash in expansion plans or in buying back their own shares. Unfortunately, companies are usually horrible at timing share buybacks and can be terrible with acquisition plans (Time Warner/AOL?). This is not to say that the home runs do not exist, just that they are incredibly hard to find and growth projections are terribly difficult to estimate.

I suggest you read James Montier’s full white paper: [Download not found]