The rather amusing broadly cited economic fact is that US growth has become more robust and we should only expect a “tailwind” from lower gas prices that will put more dollars in the US consumers’ pockets. I will not pontificate on how indications of job growth are impossible to explain, but instead point to three market facts that everyone seems to ignore.

1) Breakeven inflation rates have fallen dramatically since midsummer. Economists still expect US inflation to come in near 2% in the coming years, but the market has quickly repriced and suggested that the 2 year inflation (deflationary) rate will be .45%!

2) US Interest Rates actually look attractive versus alternatives. Despite the Economists’ beliefs that the US 10 year will hit over 3% by the end of 2015, the market forward rate says that the 10 year will not reach 3% in 10 years! More importantly, every German is thinking that US Bonds look incredibly attractive compared to their own securities:

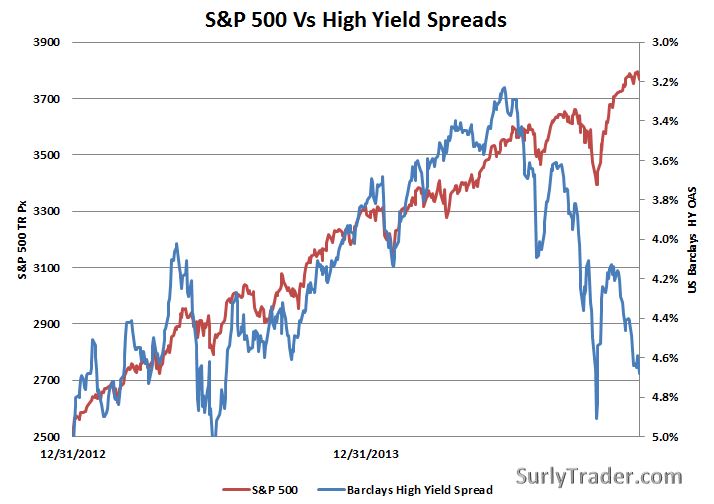

3) Despite equity markets being extremely happy, the US High Yield market has been slaughtered over the last few months. I guess you just need to believe that all fixed income markets are wrong and equities are right:

I believe the most realistic explanation is that US markets broadly believe that the Federal Reserve is planning on tightening when the economy will not be able to take the stress. It is also telling you that the rising dollar and falling crude point towards the US importing deflationary conditions from struggling economies around the world.