As I previously mentioned, Muni’s have been thrown under the bus with European sovereign debt. The fear is that the politicians will never have the discipline to cut budgets and tighten belts, just what we would expect from self-interested politicians. The truth is that municipalities are in far better shape than many sovereign nations and they are actually required to balance their budgets unlike their large brethren. Standard and Poor’s thinks the outlook is far better than perceived:

We believe the crises that many state and local administrators find themselves in are policy crises rather than questions of governments’ continued ability to exist and function. They’re more about tough decisions than potential defaults. This is because, for the states in particular, debt service generally holds a priority status relative to other obligations. Indeed, a state’s spending cuts in a recession may actually serve to protect debt service. The revenue declines that we think would likely cause default in many instances would need to be double what they were during the Great Depression.

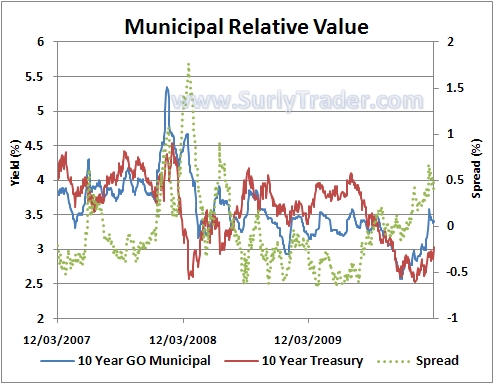

What has the fear done to the fixed income markets? As a simple measure we can look at 10 year general obligations from municipalities versus 10 year treasury yields:

The spread between general obligation tax-exempt municipals and treasury yields of similar maturity is at very attractive levels. In fact, municipals blow the lid off of most corporate bonds on a tax adjusted basis. The yields might become even loftier, but it seems like a good opportunity to scale in.