I do not like to play games where the odds are consistently stacked against me. When you play at a casino you know that over the long haul, you are helping to pay for the marble floors. If you do want to play at the casino, you at least want to play the games where the odds are closer to even so that you can enjoy a few more watered down complimentary beverages. In the trading world, I do not want to be swimming upstream. If the market is rallying or tanking, I will generally go with the flow. Likewise, when there are structural deficiencies in a strategy, I want to take advantage of those deficiencies or make sure that I am not on the wrong side of those deficiencies.

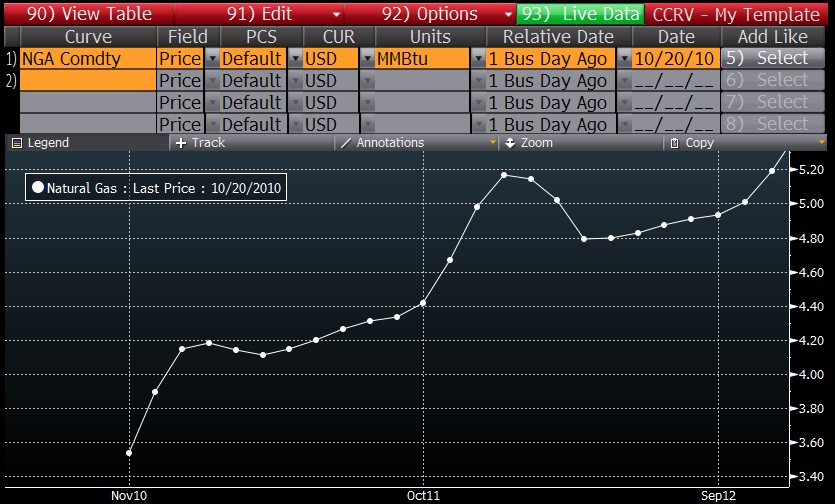

With any trading strategy where you are forced to systematically trade, you want to make sure you like the underlying system. In the case of ETN’s that trade in the futures markets, you want to make sure that the strategy fits the way that the underlying futures trade. In the case of most futures contracts where the curve is in contango, you do not want to be systematically rolling your long position, especially not at the points where the contango is at its steepest. With natural gas we can see contango along with strong seasonality:

If you buy September 2012 Natural Gas contracts for nearly $5, what happens to you if the price of natural gas does not move between now and expiration? You get killed because you lose over 50%. You might suggest that natural gas is a finite commodity, therefore as currencies devalue, supplies erode and demand increases; the price of natural gas will most definitely rise over time. You might be right, but what about financial contracts that have nothing to do with nominal prices such as the VIX?

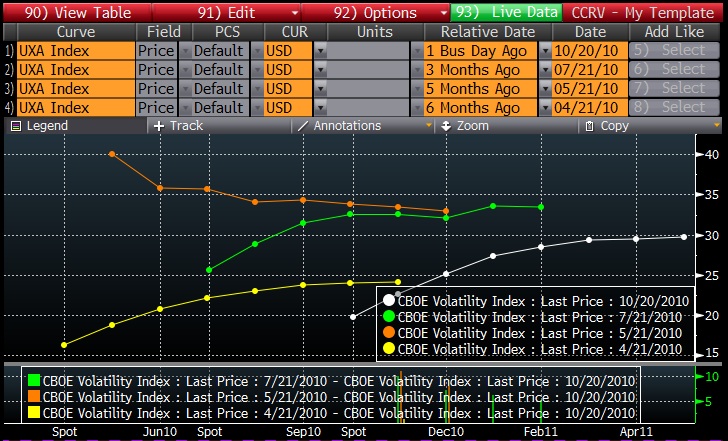

Except when the VIX is spiking (May 2010), VIX futures mostly stay in contango. This means that it costs more to buy volatility in the future than it does to buy volatility today. Volatility is a percentage, so unless you believe that volatility will rise in the future, this relationship should not last. The true reason is most likely because the future is more difficult to predict. It is much easier to predict what happens next week than it is to predict what happens three months from now. I believe that this plays into the expensive pricing of longer dated VIX futures.

The problem with this relationship is that the exchange traded note, VXX, has become a very hot product for trading the VIX. Unfortunately, VXX can only imitate the VIX by buying short dated futures and rolling the positions as they age. Because of the downward sloping nature (contango) of the VIX futures curve, you will lose money over time by holding a long position in VXX.

This contango relationship is why I actually believe the best systematic VIX futures strategy is to purchase the longer part of the VIX futures curve (VXZ) and sell the short part of the curve (VXX). Why stand in front of the bus when you can hitch a ride?